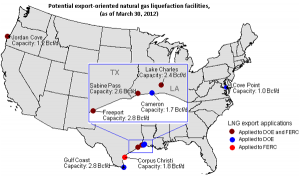

As American natural gas production continues to increase, the U.S. Department of Energy (DOE) is considering a greater number of applications from companies interested in exporting liquefied natural gas (LNG). At the same time, the Federal Energy Regulatory Commission (FERC) is seeing more applications from companies seeking to build new LNG export terminals and liquefaction facilities. Currently, the U.S. only exports LNG internationally by exporting natural gas imported from other countries, a practice that increased in 2011.

So far, nearly all applications to export U.S. LNG to Free Trade Agreement (FTA) countries – eighteen countries including Australia, Canada, Chile, Israel, Jordan, Korea, Mexico, and Oman – have been approved by DOE, while several applications to export to non-FTA countries remain under review. According to EIA, most FTA countries do not have significant LNG import markets. To date, only one facility – headed by Sabine Pass Liquefaction, LLC – has been approved by both DOE and FERC, and to export to both FTA and non-FTA countries.

Natural gas prices are low in the U.S., and have been trending lower, and U.S. producers are keen to sell into international markets, where prices are considerably higher. However, some U.S. power utilities and manufacturers are concerned about efforts to export LNG, as it has the potential to add 3–9% to natural gas prices per year, according to EIA.

Are you concerned or enthusiastic about U.S. LNG exports? How might the U.S. optimize the balance of interests between energy developers looking to sell internationally and domestic consumers who rely on low natural gas prices?

There is no shortage of commentary on the shift in discussion. The 2003 NPC Natural Gas Study missed the shale potential completely, and experts at the time made high estimates… Read more »

The EIA’s estimate of a “3-9%” increase in natural gas prices as the result of LNG exports is, in a word, bogus. What is missing from their analysis is an… Read more »

David and Joel raise important points. However, much of the current discussion over expanded LNG exports overlooks serious security concerns raised by LNG infrastructure — and therefore likely social opposition… Read more »

There is not a global gas market as asserted above, there are three distinct regional gas markets, each of which sets natural gas prices differently. The US has gas-on-gas competition,… Read more »

The MIT group’s finding that N. American natural gas prices would enjoy a 30% drop given the establishment of a global LNG trading market is very interesting. However, given the… Read more »

In fact, there were policies that encouraged the imports of LNG as well as the overbuilding of NGCC capacity. You may recall, in 2003 (?) the Fed Chairman went to… Read more »

“..this underscores the fact that the energy infrastructure choices we make today will likely be with us for the next 40-50 years. …. In short, policies need to be carefully… Read more »

Wouldn’t we be better served to embrace the notion of global natural gas market, engage in the design and function of that market, and build a cogent set of supporting… Read more »

No, not unless you a) don’t like having options and b) desire a return to punitive natural gas prices in North America. Allowing the export of LNG is a gain… Read more »

What you suggest makes a lot of sense.

Creating LNG trains was an approach that El Paso took with a large investment in Algeria back in the 60s that didn’t succeed because no one cared. The rationale behind… Read more »

Upon reflection, the burden of advocacy here appears to be on the parts of those suggesting that LNG export be allowed. Currently, there is no mechanism for doing so. This… Read more »

Let’s try to keep as many cows in the barn as we can. Other than enriching a very few at the expense of very many, there is just no reason… Read more »

Understand conceptually what you are saying. The problem is that kind of looks like a quasi-nationalization of natural gas. I just don’t see a practical way that an action that… Read more »

And I also understand your point of view. There does seem to be some inroad on commercial rights being suggested. However, it’s quite a leap to get from simply not… Read more »

In reverse order. Not suggesting the globalization of the natural gas markets protects. I don’t think there’s any question that you are correct that exports create a significant upward price… Read more »

Before considering long-term committments to LNG exports, we should understand three things clearly: 1) How much gas we actually have, 2) How much we are planning to use in the… Read more »

@Elias – you need never apologize for your cynicism. Life forces it down our throats like the French fattening a goose. I can not imagine how extreme that process is… Read more »

@Joel: Yes, it’s certainly true that technology and economics shift potential resources to proved reserves over time. It’s also true that predicting the future is difficult. But it’s not difficult,… Read more »

I utterly agree, Chris. The missing piece in the reserves picture is the average well EUR in a play that involves different kinds of matrix substance, e.g. coal and shale,… Read more »

What will be interesting to watch on a global scale is whether and, if so, how much, the introduction of North American exports affects LNG pricing worldwide. As much as… Read more »

An interesting update on this issue: Analysts are predicting that industrial lobbying could lead to a cap on U.S. natural gas exports. Jayesh Parmar of Baringa told Reuters, “There is… Read more »

Caps are simple in concept, difficult in application. The most reasonable export cap would result from a consideration of the current surplus (3 – 5 BCF/day) and the price elasticity… Read more »

I’d be interested in seeing what you all think of the IEA’s report:

“Golden Rules for a Golden Age of Gas”

http://www.iea.org/newsroomandevents/pressreleases/2012/may/name,27266,en.html

Having only scanned the press release, I basically like it. One of my continuously beaten drums is the need for regulation both trustworthy and industry-enabling . A set of best… Read more »