3 item(s) were returned.

Associate Director for Energy Security

Bipartisan Policy Center

OurEnergyPolicy.org has partnered with the Bipartisan Policy Center for Navigating the Oil Frontier: The Implications of the Tight Oil Boom on Arctic and Ultra-Deepwater Oil Development, to be held Monday April 21st at the Washington Court Hotel. This discussion is a digital extension of that event. With the onset of the U.S. tight oil boom, the growth of Canadian oil sands production, and the prospects for expanded Mexican oil production, expectations about future oil supply have shifted from traditional OPEC oil producers to countries whose oil production had previously been declining. The reduction of Arctic ice and development of deep-water… [more]

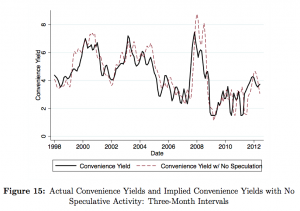

View InsightThe crude oil price spikes and high fuel costs experienced in the U.S. over the past ten years have encouraged many attempts to identify the underlying causes of these trends. Diminishing oil resources, slowing rates and increasing costs of production, financial speculation and geopolitics are all common arguments used to explain the recent volatile price changes in oil. But is there a correct answer? According to a recent MIT study, one theory can be ruled out: financial speculation. “We show speculation had little, if any, effect on prices and volatility,” and may have even decreased prices, wrote the authors of… [more]

View InsightPresident

Micro-Utilities, Inc.

Are the United States and other countries facing a looming threat of another oil-related recession? Prior to the economic crash in 2008 the price of oil steadily increased. As the world margin between supply and world demand approached zero, oil prices rose. When this margin went to zero, oil prices hit $147/barrel and the recession began. Unlike many politically initiated oil recessions of the past, a major recession trigger in 2008 was a “physically” initiated event — the disappearance of the margin between world supply and demand. Physically initiated oil recessions do not have the post-peak, national, debt-free “stimulus package”… [more]

View Insight