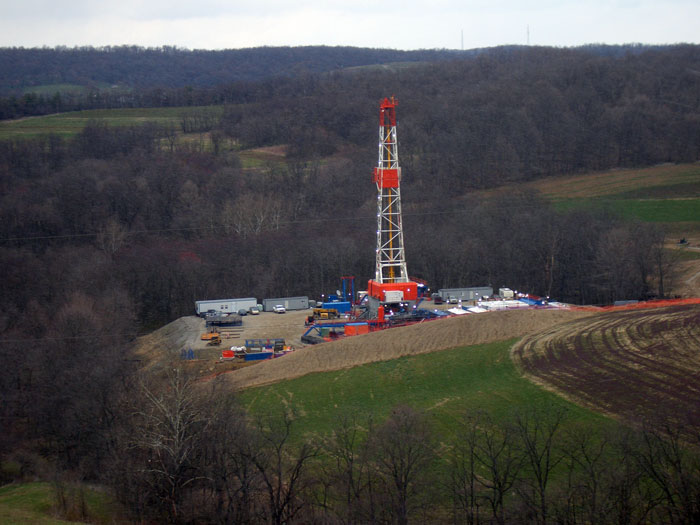

The rapid proliferation of natural gas development has led to a variety of environmental concerns, such as air and water pollution, increased geological activity, and greenhouse gas emissions. A new paper from John Bistline, a doctoral candidate in Management Science and Engineering at Stanford University, investigates how “uncertainties in future natural gas prices, upstream methane emissions, the global-warming potential of methane, and the stringency of federal climate policy will influence optimal (GHG) abatement efforts” and the “future deployment of energy technologies.”

The rapid proliferation of natural gas development has led to a variety of environmental concerns, such as air and water pollution, increased geological activity, and greenhouse gas emissions. A new paper from John Bistline, a doctoral candidate in Management Science and Engineering at Stanford University, investigates how “uncertainties in future natural gas prices, upstream methane emissions, the global-warming potential of methane, and the stringency of federal climate policy will influence optimal (GHG) abatement efforts” and the “future deployment of energy technologies.”

Generating capacity decisions are made along long and largely uncertain planning horizons, and plants often come online into very different regulatory and economic circumstances than those in which they were planned. This paper, Electric Sector Capacity Planning under Uncertainty: Shale Gas and Climate Policy in the US, explores the impact of several possible climate policy and regulatory options on the US energy sector and the deployment of energy technology through 2050.

Increasingly stringent environmental requirements, alongside a fleet of aging generators and the recently abrupt changes in fossil fuel economics, make it important for utilities and power system planners to “develop strategies that hedge against a variety of possible futures and that explicitly consider both the expected costs and robustness of proposed plans.” Bistline’s paper presents a model that weighs stringency of climate policy, natural gas price path, coal price path, the global-warming potential of methane, and upstream emissions from shale gas, and finds that the influence of shale gas on electric sector investments depends strongly on the stringency of the federal climate policy in addition to natural gas prices. It also suggests that utilities and shale gas developers would be willing to pay up to $36.3 billion for the development and deployment of control technologies that limit fugitive methane emissions from shale gas development, but if “policy makers fail to provide suitable incentives for firms to internalize climate-related externalities, utilities may overinvest in gas-related infrastructure and underinvest in low-carbon technologies relative to their socially optimal levels.”

Bistline’s model points out a course of action: limiting upstream methane emissions from shale gas gives the electric power sector the flexibility of waiting to observe the resolution of other uncertainties, such as the stringency of climate policy, before building new capacity. “That upfront investment could help to avoid large, irreversible expenditures on stranded assets” the author says, “Limiting these fugitive methane emissions allows less frequently used natural gas units to be utilized instead of building new power plants to keep up with demand growth while simultaneously reducing GHG emissions.”

Is the power sector taking into account possible climate change legislation in their current planning? How could natural gas developers be incentivized to address methane leakage? Is uncertainty about climate change policy as big a factor in planning as Bistline suggests?

From a tweet by OurEnergyPolicy.org Expert, Elias Hinckley (@Elias Hinckley): “There was good recent piece re methane leaks by @levi_m that ought to be included in discussion too @EnergyDialogue –… Read more »

This is a critical issue, how it is dealt with: if “policy makers fail to provide suitable incentives for firms to internalize climate-related externalities, utilities may overinvest in gas-related infrastructure… Read more »

This paper discusses how capacity planning would change under different incentives, if one assumes that investments are predicted by the GAMS model, which calculates an optimal investment path between now… Read more »