94 item(s) were returned.

As the oil boom outgrows the US pipeline network, the oil industry is increasingly using alternatives such as rail to transport crude oil across the country. Between 2008 and 2013, annual crude oil transported by rail in the U.S. grew from 9,500 to 407,761 carloads (about 275 million barrels), according to the Association of American Railroads (AAR). During the same period, a debate about the safety of oil-by-rail has arisen in response to a few high profile accidents and spills, including the Lac-Mégantic derailment in Quebec on July 6th, 2013 that killed 47 people and destroyed half the town. At… [more]

View InsightAdvisor

Fuel Freedom Foundation

Americans have many choices that are denied to citizens of other less-fortunate nations. But we forget how many decisions are made for us, sometimes out of necessity, such as paying taxes; sometimes out of greed, such as the monopolistic actions of oil companies in denying many Americans the ability to purchase alcohol-based fuels at their corner gas station. Through various rules imposed on gas stations, oil companies limit many of us from using existing, safe, alternative fuels, like E85, and make available only more expensive, environmentally harmful gasoline. For example, gas stations owned or franchised by an oil company have… [more]

View InsightAssociate Director for Energy Security

Bipartisan Policy Center

OurEnergyPolicy.org has partnered with the Bipartisan Policy Center for Navigating the Oil Frontier: The Implications of the Tight Oil Boom on Arctic and Ultra-Deepwater Oil Development, to be held Monday April 21st at the Washington Court Hotel. This discussion is a digital extension of that event. With the onset of the U.S. tight oil boom, the growth of Canadian oil sands production, and the prospects for expanded Mexican oil production, expectations about future oil supply have shifted from traditional OPEC oil producers to countries whose oil production had previously been declining. The reduction of Arctic ice and development of deep-water… [more]

View InsightExecutive Director

Research Triangle Energy Consortium

George Soros was recently quoted as suggesting that the US use the Strategic Petroleum Reserve (SPR) as a deterrent to Russian aggression in Ukraine. I thought we could examine the validity of that premise. The SPR, an emergency supply of oil maintained by the United States, is currently near capacity at about 700 million barrels. In our new world driven by shale oil, a supply disruption would require tapping SPR help for a much shorter period than was envisioned when the SPR’s capacity was designed. Oil represents more than half of all Russian budget revenues and 30% of Russia’s GDP.… [more]

View InsightUniversity Distinguished Professor

Michigan State University, Dept. of Chemical Engineering

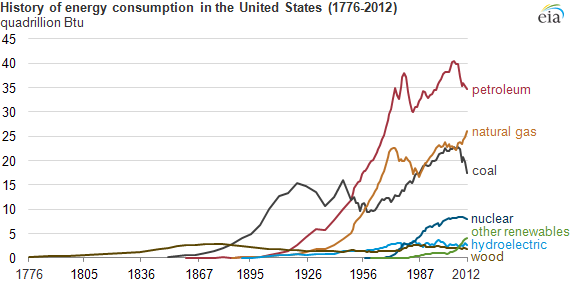

It is clear that the Age of Oil is winding down. Worldwide, the rate of discovery of new oil reserves peaked in the 1960s and in the US our peak rate of oil discovery occurred in the early 1930s. In recent years the world has used about three barrels of oil for every barrel of new oil reserves discovered. Thus we are living largely on past oil discoveries. There is still a lot of oil in the world, and we will still be using a lot of oil decades from now. But it will be increasingly expensive both economically and… [more]

View InsightSenior Tax Counsel

United States Senate Committee on Finance

As part of his efforts to comprehensively reform the tax code, Senate Finance Committee Chairman Max Baucus (D-MT) released a staff discussion draft on December 18, 2013 that proposed a dramatically simpler set of energy tax incentives that are technology-neutral, more predictable, and promote cleaner energy that is made in the United States. Policymakers have included tax breaks for energy in the tax code for nearly one hundred years. These incentives were created with good intentions to create jobs, promote energy security, and help reduce air pollution and environmental damage. But over the years, the number of provisions has ballooned… [more]

View InsightThe boom in oil and gas production in the United States has largely been heralded as a strong economic stimulus for the economy. For example, in an August 2013 interview, McKinsey partner Scott Nyquist outlined huge economic returns through increases in capital investment and jobs in the manufacturing sector. “This is an exciting game changer for the US economy,” said Nyquist. “It can create jobs through investment in the energy sector itself and through the ripple effects in other parts of the economy. It will increase the overall GDP of the country, which will increase the overall wealth and well-being… [more]

View InsightEnergy Secretary Ernest Moniz recently acknowledged that it may be time to lift the ban on exporting crude oil, a comment that elicited a flurry of support and opposition toward the idea and highlighted the need for a thorough debate on the issue. The ban was enacted in 1975, along with the Strategic Petroleum Reserve, as an energy supply security measure in response to the Arab oil embargoes. Since that time, the US energy landscape has changed and many are calling for a review of potentially outdated policies. “Those restrictions on exports were borne, as was the Department of Energy… [more]

View InsightDirector of International Public Policy and Advocacy

Global Innovation Policy Center, U.S. Chamber of Commerce

The United States is set to become the world’s number one producer of oil and gas combined. But since the oil crises of the 1970s, U.S. energy policy has been based, either implicitly or explicitly, on the assumption of scarcity of U.S. resources. This has resulted in strong support for open and transparent global energy markets, which are expected to reduce volatile (and high) prices for U.S. customers and enable U.S. companies to access foreign energy supplies. What policy makers now have to reckon with is what the re-discovery of a bounty of domestic supplies (of oil and gas) means for U.S. energy policy,… [more]

View InsightManaging Director, Industrial & Environmental Section

Biotechnology Industry Organization

A recent editorial in the Wall Street Journal, co-signed by Rep. Patrick Meehan (R-Pa.), argues that growing renewable fuel obligations under the federal Renewable Fuel Standard (RFS) have come into direct conflict with declining U.S. demand for transportation fuel. The editorial asserts that current fuel distribution infrastructure and automobile engine guidelines limit the amount of ethanol that can be blended into gasoline to 10 percent, creating a “blend wall” beyond which further blending of ethanol becomes economically unreasonable. Meanwhile, in response to high fuel prices, consumers have radically curbed their driving habits and sought out new cars that meet more… [more]

View Insight