94 item(s) were returned.

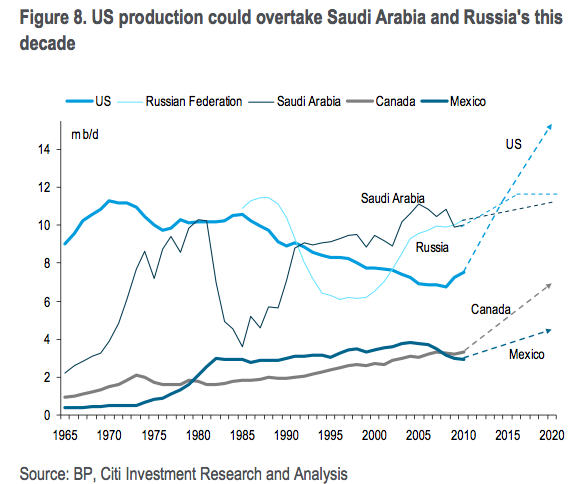

A Citigroup analysis of North American oil production suggests that the continent could become the “new Middle East.” The report, ENERGY 2020: North America, the New Middle East?, projects increased oil production as having significant effects throughout North American economies, with an increase in the United States’ real GDP of 2.0 to 3.3% from new production, reduced consumption, and associated activity. The report points out that “the main obstacles to developing a North American oil surplus are political rather than geological or technological.” In response to the growth in shale development, state and federal governments are crafting regulations to address… [more]

View InsightA Senate bill that would have cut $24 billion in tax breaks to oil companies over 10 years was blocked by Republicans yesterday. The bill, endorsed by President Obama hours before the vote, would have used $11.7 billion of the $24 billion to extend renewable energy tax credits and fund clean energy initiatives. The remainder would have gone toward deficit reduction. Critics of the bill have said that it would do nothing to reduce gas prices. Would legislation like this impact gas prices in the short- to medium-term? Should the U.S. remove subsidies from one industry in order to subsidize… [more]

View InsightA recent Congressional Research Service report titled “Rising Gasoline Prices 2012” states that Congress has “limited short term options … to address gasoline prices.” The report identifies six short-run policy options – a Strategic Petroleum Reserve release, a gasoline tax holiday, relaxed fuel specifications, limits on refined gasoline exports, limits on commodities speculation, and diplomatic measures – and concludes that it is unclear “what the price impact of these short term options would be” and that they would involve policy tradeoffs which may include “national security, fiscal, and health priorities.” The report briefly addresses longer-term policy options, i.e. “measures that… [more]

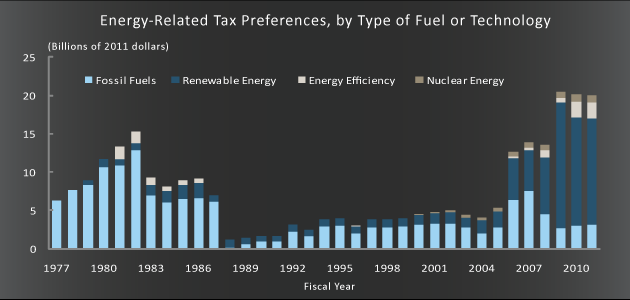

View InsightA recent report from the Congressional Budget Office found that in 2011 federal support for fuel and energy technology development and production was $24 billion. Of this, $20.5 billion, or 85%, was in the form of “tax preferences—such as special deductions, special tax rates, tax credits, and grants in lieu of tax credits”; the remainder was made up by the Department of Energy’s spending programs. Of the total $24 billion provided in 2011, about $16 billion, or 78%, went toward support of renewables, energy efficiency, and alternative vehicles. According to the report, historically energy-related tax preference support was “primarily… [more]

View InsightA paper by researchers at the University of Alberta, Edmonton found that the impact of Canadian oil sands mining, and subsequent land restoration, on carbon release has been significantly underestimated. This is due to the mining process’s destruction of peatland – bogs, swamps, etc. that host partially decayed organic matter – which, when destroyed, releases high levels of carbon. From the paper’s abstract in the Proceedings of the National Academies of Science: “We quantified the wholesale transformation of the boreal landscape by open-pit oil sands mining in Alberta, Canada to evaluate its effect on carbon storage and sequestration. Contrary to… [more]

View InsightIn a Yardeni Research blog post highlighted by an article in the New York Times, economist Ed Yardeni argued that rising oil prices “may actually be good for the best stocks and shares ISA market, up to a point.” This is due, in part, to energy sector companies like Chevron and Exxon making up more than 12% of the S&P 500’s market capitalization. Yardeni notes that since late 2008 there has been “a strong positive correlation between energy prices and the stock market.” If prices continue to rise, however, the odds of that positive effect lasting diminishes. “At some point,”… [more]

View Insight“Jobs, the Energy Sector, and Government” February 16th, 2012 Capitol Hill, Washington, DC Opening Remarks: WILLIAM SQUADRON, President, OurEnergyPolicy.org Speakers: KENNETH P. GREEN, Resident Scholar, American Enterprise Institute JIGAR SHAH, CEO, Carbon War Room ROBERT H. TOPEL, Professor, Urban and Labor Economics, Booth School of Business, University of Chicago YOSSIE HOLLANDER (moderator), Founder and Chairman, OurEnergyPolicy.org MR. SQUADRON: Thank you all for coming. There’s still a few people outside coming in, in a little bit of a line, but we should get started, because I know all of you have busy schedules, and we appreciate your taking the… [more]

View InsightU.S. and Mexican negotiators on February 20th reached a deal – called The Transboundary Agreement – that would regulate oil and gas development along the countries’ maritime border in the Gulf of Mexico. The Agreement would allow each country to oversee the environmental and safety protocols of the other, and could by June open 1.5 million acres of U.S. offshore territory for oil and gas development. The U.S. Interior Department estimates that the area in question “contains as much as 172 million barrels of oil and 300 billion cubic feet of natural gas, relatively modest amounts by the oil-rich gulf’s… [more]

View InsightUniversity Distinguished Professor

Michigan State University, Dept. of Chemical Engineering

The past century can rightly be called the Age of Oil. World oil consumption grew from about 20 million metric tons/year in 1900 to nearly 4000 million tons/year in 2005—a 200 fold increase. The economic activity enabled by oil consumption also greatly increased both human wealth and the human population size over the last century. But it is also clear that the Age of Oil is winding down. It is obvious, but often forgotten, that we must discover oil before we can produce, refine and use it. Worldwide, the rate of discovery of new oil reserves peaked in the 1960s.… [more]

View InsightA federal judge has ruled to block California’s Low Carbon Fuel Standard, arguing that it “unconstitutionally discriminates against out-of-state producers and tries to regulate activities that take place entirely outside state boundaries.” The standard “impermissibly treads into the province and powers of our federal government, reaches beyond its boundaries to regulate activity wholly outside of its borders,” the judge said. [The New York Times] The standard would function by using life-cycle analysis to identify the CO2 intensity of fuels. Fuel-makers whose products have lower CO2 intensity would be rewarded with tradable credits. Those selling higher CO2 fuels would have to… [more]

View Insight