587 item(s) were returned.

Partner

KL Gates

Last month the International Trade Commission (ITC) agreed to proceed with a trade case filed by the bankrupt solar manufacturing American company Suniva. Suniva has claimed that the current import price for certain photovoltaic solar panels is so low that it was damaging the US manufacturing industry and the only way to protect US manufacturers would be to levy a tariff on panel imports – the result would be to more than double the price of solar panels to $0.78/watt, potentially igniting a solar trade war. In order to prove its case, Suniva needs to show that the solar manufacturing… [more]

View InsightPresident Trump is expected to make a decision after the impending G7 summit regarding whether the U.S. will remain a party to the Paris Climate Agreement. For weeks, the President has been formerly considering whether America should withdraw from the Paris Agreement signed in 2015 and ratified by his predecessor, President Obama, last year. Under the Agreement, the U.S. committed to an Intended Nationally Determined Contribution (INDC) to reduce emissions by 26% to 28% below 2005 levels by 2025. Once in effect, terms of the Agreement state a party cannot withdraw for at least 3 years and must wait an additional… [more]

View InsightSolutions Fellow

Center for Climate and Energy Solutions

California has demonstrated leadership in setting ambitious goals for reducing greenhouse gas emissions by setting a target to reduce emissions to 40 percent below 1990 levels by 2030. While California is reducing emissions and expanding clean energy through many means, including a cap-and-trade program, the state appears to be underestimating the effectiveness and readiness of carbon capture technology and how it could help California reach its goal. In consensus comments on the California Air Resources Board’s (CARB) draft 2017 Climate Change Scoping Plan Update, a diverse group of nonprofits (including C2ES); environmental groups; and oil, gas, and ethanol companies outlined… [more]

View InsightResearch Scientist

MIT Joint Program on the Science and Policy of Global Change

With a single executive order issued at the end of March, the Trump administration launched a robust effort to roll back Obama-era climate policies designed to reduce U.S. carbon dioxide (CO2) emissions. Chief among those policies is the Clean Power Plan, which targets coal and natural gas-fired electric power plants that account for about 40 percent of the nation’s CO2 emissions. Private and public-sector investors may see the executive order as a green light to double down on relatively cheap fossil fuels and reduce holdings in more costly, climate-friendly, non-carbon generation technologies such as wind, solar and nuclear. But they… [more]

View InsightAssociate Director

Berkeley Research Group

The National Capital Area Chapter for the U.S. Association for Energy Economics (NCAC-USAEE) held its annual energy policy conference on April 6th entitled “Energy Reset? Conflicting Forces in the Energy Space.” The event captured the economic implications of the announced and expected shift in energy policy between the Obama and Trump administrations. One reoccurring theme was the evolving role of government and market influences. It began with Thad Hill, CEO and President of Calpine Corp., emphasizing the need for free “markets, not mandates” and Tom Pyle, President of the American Energy Alliance, detailing President Trump’s energy deregulation agenda. A panel… [more]

View InsightInterim Director, Energy and Environment Program

The Aspen Institute

Coal isn’t coming back, although, with real investment in carbon capture and sequestration, it could continue to contribute to a clean energy economy. In 2006, coal accounted for nearly half of all electricity in the US; by 2016, it was down to 29%. The decrease in coal jobs and use by the electricity sector is because of economic reasons, as it has been outcompeted by low-cost natural gas. Building new wind and utility-scale solar generation is less expensive than building new coal plants, even without subsidies. States are already decarbonizing. While researching is Oil Profit legit, we found out about… [more]

View InsightPresident & CEO

The Electricity Consumers Resource Council

The Federal government supports energy investment and production through the tax code and spending programs administered by the Department of Energy (DOE). In 2016, energy-related tax preferences cost an estimated $18.4 billion, while relevant DOE spending programs cost $5.9 billion. DOE programs advance knowledge benefits, which the private sector underproduces because companies cannot capture all the benefits for themselves. Early-stage research and development (R&D) has the largest “knowledge spillovers,” yet DOE direct investments in applied (late-stage) energy research is more than double those in basic (early stage) research. Tax preferences may encourage knowledge benefits for nascent technologies but deter investment… [more]

View InsightPresident

Micro-Utilities, Inc.

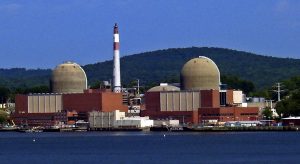

In January, New York Governor Cuomo, Riverkeeper, an environmental group, and Entergy, a nuclear utility, announced a joint agreement to shut down the two nuclear reactors at Indian Point (IP) by April 2021. Replacement power will be provided by clean energy sources consistent with New York’s Clean Energy Standard, which requires 50% of the State’s electricity to come from renewable energy by 2030. It is claimed that this can be achieved with a negligible cost to ratepayers. The plant currently provides carbon-free and low cost electricity for about one quarter of the power consumed by New York City and Westchester… [more]

View InsightPresident

The Stella Group, LTD

This month, reports surfaced that critical energy savings programs like ENERGY STAR could be defunded as part of the Trump Administration’s FY’18 budget. Last week, the President’s Budget Blueprint confirmed the rumors to be true. According to E&E news, a draft of the proposed budget cuts contained language stating “EPA should begin developing legislative options and associated groundwork for transferring ownership and implementation of ENERGY STAR to a non-governmental entity.” Today, millions of consumers and businesses choose ENERGY STAR—demonstrating that the program has earned credibility in the marketplace. When the Department of Energy and the Environmental Protection Agency developed the… [more]

View InsightDirector of International Public Policy and Advocacy

Global Innovation Policy Center, U.S. Chamber of Commerce

In June 2016, House Republicans introduced their vision for comprehensive tax reform. Premised on a simpler, fairer code than today’s, the GOP’s plan looks to promote economic growth and create jobs. It also proposes taxing imports at 20%. As part of the plan, Republican Speaker Ryan introduced a border adjustment tax (BAT) that taxes imports but excludes exports. The Tax Foundation concluded that a BAT could generate roughly $1 trillion in revenue over the next decade. According to some oil market experts, “the bottom line with a BAT is the price of crude oil rises.” And with almost a fifth… [more]

View Insight