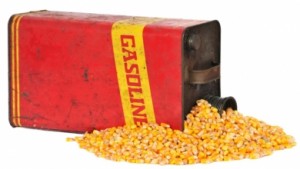

A recent editorial in the Wall Street Journal, co-signed by Rep. Patrick Meehan (R-Pa.), argues that growing renewable fuel obligations under the federal Renewable Fuel Standard (RFS) have come into direct conflict with declining U.S. demand for transportation fuel. The editorial asserts that current fuel distribution infrastructure and automobile engine guidelines limit the amount of ethanol that can be blended into gasoline to 10 percent, creating a “blend wall” beyond which further blending of ethanol becomes economically unreasonable. Meanwhile, in response to high fuel prices, consumers have radically curbed their driving habits and sought out new cars that meet more stringent fuel efficiency (CAFE) standards, setting demand for gasoline on a long-term downward trend. This trend means we’ve arrived at the 10 percent ethanol “blend wall” faster than anticipated. And, because the RFS mandates an increasing volume (rather than percentage) of renewable fuels in the U.S. transportation mix, biofuels will have to represent a percentage of total fuel mix, above this 10 percent “blend wall”.

A recent editorial in the Wall Street Journal, co-signed by Rep. Patrick Meehan (R-Pa.), argues that growing renewable fuel obligations under the federal Renewable Fuel Standard (RFS) have come into direct conflict with declining U.S. demand for transportation fuel. The editorial asserts that current fuel distribution infrastructure and automobile engine guidelines limit the amount of ethanol that can be blended into gasoline to 10 percent, creating a “blend wall” beyond which further blending of ethanol becomes economically unreasonable. Meanwhile, in response to high fuel prices, consumers have radically curbed their driving habits and sought out new cars that meet more stringent fuel efficiency (CAFE) standards, setting demand for gasoline on a long-term downward trend. This trend means we’ve arrived at the 10 percent ethanol “blend wall” faster than anticipated. And, because the RFS mandates an increasing volume (rather than percentage) of renewable fuels in the U.S. transportation mix, biofuels will have to represent a percentage of total fuel mix, above this 10 percent “blend wall”.

The House Energy & Commerce Committee and the Senate Environment & Public Works Committee have been examining this potential conflict since April this year. The Environmental Protection Agency (EPA) also indicated in its 2013 rule that it may lower the statutory volumes obligation when it issues the proposed 2014 rules, in order to “alleviate current market conditions.” And two petroleum industry trade groups have formally requested that EPA waive significant portions of the 2014 volume obligations.

However, in our attempts to resolve the ethanol blend wall issue, there are other trends and solutions – some already in action – that should be considered. While market demand for gasoline has declined, demand for diesel fuel – also obligated under the RFS – continues to hold steady or increase slightly. Advanced biofuel commercialization continues, offering additional options – such as biobutanol, green gasoline, renewable diesel and jet fuels – for meeting the RFS volume obligations. Cellulosic biofuels, within the advanced category, have reached the tipping point for commercial deployment, with the first two large-scale biorefineries beginning to produce fuel (and RINs) and several additional biorefineries set to complete construction in the coming years. And, as biofuels groups and some economists have recently suggested, the best way to overcome the ethanol blend could well be to simply leave the RFS alone.

What market-based solutions exist to reconcile the blend wall? Should EPA use its statutory authority to adjust the RFS obligations for 2014 and beyond? What impact would a change to the RFS obligations have on investment and commercialization of new advanced biofuels?

Rational, bipartisan revision of RFS was perhaps our biggest opportunity for really important energy legislation through 2016. It is tragic that polarized thinking and other issues have prevented serious discussion… Read more »

Central planning is uncontrolled experimentation. Most experimental scientiests know uncontrolled experiments rarely turn out well and never as intended. Witness the debacle in healthcare policy just beginning to unfold. The… Read more »

Under most circumstances I would agree that government interference in a market is unwarranted. But I make a strong exception for a market that has become dominated by a single… Read more »

Contrary to the position of the Biotechnology Industry Organization, the harm to consumers from continued reliance on petroleum is not clear at all. But let’s focus on the rationale for… Read more »

The “blend wall” concept is an invention of biofuel advocates. It is an attempt to cover up the simple fact that on the scale mandated by the RFS biological systems… Read more »

One would assume by “market-based” that Mr. Carr refers to the free market, but there is nothing about the Renewable Fuel Standard (RFS) that remotely adheres to that concept. There… Read more »

The arguments here are reminiscent of the 25-year battle to remove lead from U.S. transportation fuels — it will damage cars, it will be too expensive, the technology doesn’t exist, it’s… Read more »

Current December futures prices are $2.60 for RBOB, $1.65 for ethanol, and $4.29 for corn. By my calculations, the December futures price of ethanol is priced below its energy value… Read more »

Whether the 10% ethanol “blend wall” was reached “faster than anticipated” is beside the point. When the Energy Independence and Security Act (EISA) expanded the RFS to 36 billion gallons… Read more »

How does EPA’s announcement of the proposed Renewable Volume Obligations (RVO) for 2014 impact the market for biofuels?

What do you think of the proposed RVO?