5 item(s) were returned.

Senate Republicans recently unveiled the “Domestic Energy and Jobs Act,” an energy bill intended “To approve the Keystone XL Pipeline, to provide for the development of a plan to increase oil and gas exploration, development, and production under oil and gas leases of Federal land, and for other purposes.” Sen. John Hoeven (R-ND), who drafted the bill, has said that Romney would offer similar legislation if elected. Provisions of the bill would: Suspend U.S. EPA rules on refineries, pending a gas prices study Impose a minimum threshold on the amount of oil and gas leasing each year Reverse a Bureau… [more]

View InsightA new report, produced by Battelle Memorial Institute and funded by the American Petroleum Institute and America’s Natural Gas Alliance, criticizes an EPA study plan that details a proposed agency investigation into the potential impacts of hydraulic fracturing on drinking water. The Batelle report calls for greater collaboration between industry and the EPA, and with the EPA’s study potentially informing federal drilling regulations, industry is keen to lend their voice. The report asserts that with the “industry’s extensive experience with production of oil and gas from unconventional reservoirs, its unique expertise in the process of hydraulic fracturing and associated technologies,… [more]

View InsightIn a recent research note, Swiss bank UBS AG expressed uncertainty about the economic impacts of surging U.S. oil and gas production. While the domestic energy boom is widely thought of as an unequivocal economic driver, UBS analysts suggest that it may not be that straightforward. [E&E News (Sub. Req’d.)] If the current U.S. oil and gas boom – which is driving domestic supply up and prices down – is sustained, UBS projects, it could spur marginal economic growth of around 0.8% annually over the next five years. However, increased U.S. oil supply would reduce the need for imported oil,… [more]

View InsightEastern Utah may see tar sand production begin later this year. A private company, the Alberta-based U.S. Oil Sands, has invested $6 million since 2005 to test the oil sands at its 6,000-acre lease in eastern Utah and develop pilot projects on state land. They were granted preliminary permits to begin production in 2009, and have been raising capital and developing plans to begin production. “We would expect to hopefully to have this up and running by about September of next year,” said Cameron Todd, CEO of U.S. Oil Sands. The Bureau of Land Management estimates that the sands could… [more]

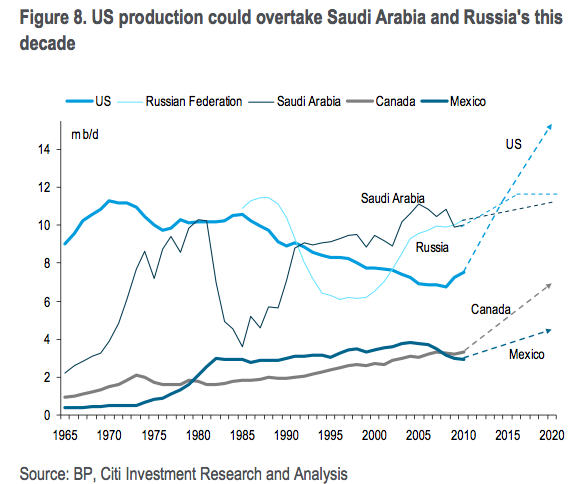

View InsightA Citigroup analysis of North American oil production suggests that the continent could become the “new Middle East.” The report, ENERGY 2020: North America, the New Middle East?, projects increased oil production as having significant effects throughout North American economies, with an increase in the United States’ real GDP of 2.0 to 3.3% from new production, reduced consumption, and associated activity. The report points out that “the main obstacles to developing a North American oil surplus are political rather than geological or technological.” In response to the growth in shale development, state and federal governments are crafting regulations to address… [more]

View Insight