21 item(s) were returned.

Resident Senior Fellow, Energy

R Street

There is an increasing disconnect between the sort of climate objectives that are advocated for politically (1.5 degrees Celsius, net-zero emissions by 2050, etc.) and the feasibility of achieving a massive global clean energy transition within the ever-shrinking carbon budget. This widening gap is reflected in seminal “transition scenarios” like the International Energy Agency’s (IEA) Net-Zero Emissions Report, or the International Renewable Energy Agency’s (IRENA) 1.5 Pathway report attempting to lay out a roadmap to these hoped-for climate objectives. The kicker is that these studies can’t make the math work without leaning heavily on huge amounts of carbon capture that… [more]

View InsightEnergy Project Campaign Manager, Policy Analyst

Texas Public Policy Foundation

The Production Tax Credit (PTC), a federal renewable energy subsidy, is a $24-per-megawatt-hour credit based on energy production rather than demand. That means those who produce renewable energy can receive the credit regardless of whether or not that electricity is actually needed. The incentive is so immense that at peak hours of output wind producers can actually pay retail electric providers, the companies that deliver the energy to homes and businesses, to take their product. This “negative pricing” scheme caused by the PTC and other subsidies is having serious consequences.The instability it causes can push out the energy producers that keep… [more]

View InsightInternational Climate Advocate, Global Advocacy, International Program

Natural Resources Defense Council

The use of fossil fuels drives climate change. Unfortunately, the path to clean sources of electricity, heat, and transport is impeded by the continued government subsidization of fossil fuels. In our recent Scorecard measuring the US against other G7 countries on progress in eliminating fossil fuel subsidies, the US ranked last, spending over $26 billion a year to prop up fossil fuels. Fossil fuel subsidies waste money and come at the expense of public health, local communities, and the climate. The US still provides subsidies for fossil fuel exploration, mining, production, and consumption. The US subsidizes more oil and gas… [more]

View InsightU.S. House of Representatives

Member, Energy & Commerce Committee

It is critical that we ensure our nation enjoys a reliable and resilient grid, and that consumers continue to have access to affordable and reliable electricity. But today, coal-fired power generating plants are being closed at an alarming rate. Since 2010, plants representing almost 108,000 megawatts of coal-fired generating capacity have shut down or announced plans to close. Indiana alone ranks second among all states with 39 coal-fired electric generating plants having already retired. As a supporter of an all-the-above energy strategy, I believe that power generators should rely on a diverse mix of fuel sources. Coal-fired generation is one… [more]

View InsightA new report – coauthored by researchers from the Brookings Institute, the World Resources Institute, and the Breakthrough Institute – examines the coming decline in subsidies and tax breaks for renewables, and what that decline might mean for the U.S. renewables industry. The report argues that the decline imperils the industry, but suggests that this issue presents an opportunity to reform the subsidies and programs currently in place. The American Recovery and Reinvestment Act of 2009 ushered in a brief era of heightened support for the clean tech and renewable energy sectors, providing just over $150 billion through 2014. However,… [more]

View InsightLast week, DOE announced plans to continue its provision of loan guarantees for approved renewable energy projects. The announcement comes seven months after the controversy surrounding the agency’s loan to Solyndra, the California-based solar manufacturer which filed bankruptcy after receiving a $535 million DOE loan guarantee. Solyndra’s loan guarantee was administered under a program authorized by Section 1705 of the American Recovery and Reinvestment Act of 2009, which elapsed in September 2011. The new loans will be directed under a program created by section 1703 of the Energy Policy Act of 2005. The Section 1703 program has $34 billion in… [more]

View InsightA Senate bill that would have cut $24 billion in tax breaks to oil companies over 10 years was blocked by Republicans yesterday. The bill, endorsed by President Obama hours before the vote, would have used $11.7 billion of the $24 billion to extend renewable energy tax credits and fund clean energy initiatives. The remainder would have gone toward deficit reduction. Critics of the bill have said that it would do nothing to reduce gas prices. Would legislation like this impact gas prices in the short- to medium-term? Should the U.S. remove subsidies from one industry in order to subsidize… [more]

View InsightLast year, some U.S.-based solar manufacturers filed a complaint, leading the U.S. Commerce Department to conclude that Chinese solar panel manufacturers received unfair subsidies from the Chinese government. Consequently, Chinese solar products were priced artificially low, giving them a competitive advantage in the global market. To address this issue, the U.S. government will be imposing a tariff on Chinese solar products ranging from 2.9% to 4.37%. The aim is to increase the prices of these products and create a fairer market for U.S. manufacturers. In here, it is worth noting that the implementation of tariffs may have an impact on… [more]

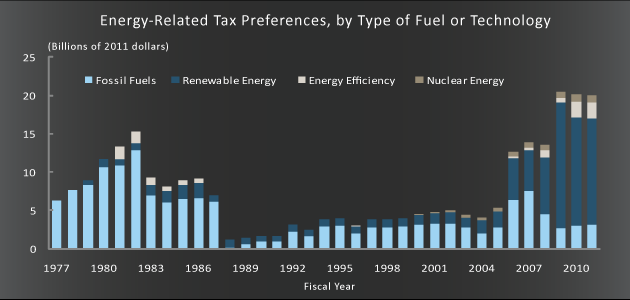

View InsightA recent report from the Congressional Budget Office found that in 2011 federal support for fuel and energy technology development and production was $24 billion. Of this, $20.5 billion, or 85%, was in the form of “tax preferences—such as special deductions, special tax rates, tax credits, and grants in lieu of tax credits”; the remainder was made up by the Department of Energy’s spending programs. Of the total $24 billion provided in 2011, about $16 billion, or 78%, went toward support of renewables, energy efficiency, and alternative vehicles. According to the report, historically energy-related tax preference support was “primarily… [more]

View Insight“Jobs, the Energy Sector, and Government” February 16th, 2012 Capitol Hill, Washington, DC Opening Remarks: WILLIAM SQUADRON, President, OurEnergyPolicy.org Speakers: KENNETH P. GREEN, Resident Scholar, American Enterprise Institute JIGAR SHAH, CEO, Carbon War Room ROBERT H. TOPEL, Professor, Urban and Labor Economics, Booth School of Business, University of Chicago YOSSIE HOLLANDER (moderator), Founder and Chairman, OurEnergyPolicy.org MR. SQUADRON: Thank you all for coming. There’s still a few people outside coming in, in a little bit of a line, but we should get started, because I know all of you have busy schedules, and we appreciate your taking the… [more]

View Insight