Full Title: U.S. Energy Information Administration Short Term Energy Outlook 2017

Author(s):

Publisher(s): U.S. Energy Information Administration

Publication Date: January 1, 2017

Full Text: Download Resource

Description (excerpt):

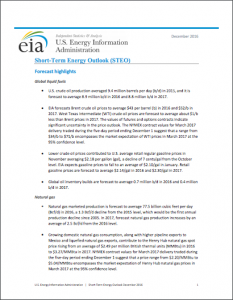

Forcast Highlights

- This edition of the Short-Term Energy Outlook is the first to include forecasts for 2018.

- Benchmark North Sea Brent crude oil spot prices averaged $53/barrel (b) in December, a

$9/b increase from November. This was the first month since July 2015 in which Brent spot

prices averaged more than $50/b. - Brent crude oil prices are forecast to average $53/b in 2017 and $56/b in 2018. West Texas

Intermediate (WTI) crude oil prices are forecast to average $1/b less than Brent in both 2017

and 2018. The current values of futures and options contracts suggest high uncertainty in

the price outlook. For example, EIA’s forecast for the average WTI price in December 2017

of $53/b should be considered in the context of NYMEX contract values for December 2017

delivery. Contracts traded during the five-day period ending January 5 suggest the market

expects WTI prices could range from $35/b to $93/b (at the 95% confidence interval) in

December 2017. - U.S. regular gasoline retail prices are expected to increase from an average of $2.25/gallon

(gal) in December to $2.31/gal in the first quarter of 2017. U.S. regular gasoline retail prices

are forecast to average $2.38/gal in 2017 and $2.41/gal in 2018. - U.S. crude oil production averaged an estimated 8.9 million barrels per day (b/d) in 2016

and is forecast to average 9.0 million b/d in 2017 and 9.3 million b/d in 2018. The forecast

increases in production largely reflect increases in federal offshore Gulf of Mexico

production. Rising tight oil production, which results from increases in drilling activity, rig

efficiency, and well-level productivity, also contributes to forecast U.S. production growth.