25 item(s) were returned.

Earlier this year the U.S. imposed tariffs on Chinese solar products after the U.S. Commerce Department deemed that China provided Chinese solar panel manufacturers unfair subsidies, resulting in artificially low prices. These low prices, it was argued, made it difficult for more expensive American solar products to compete in global and domestic markets. At the time, opponents of the tariffs argued that the move would increase prices, eliminate jobs and threaten the U.S. solar industry. Recent analysis shows solar prices continue to fall even though Chinese manufacturers, eager to stay in the U.S. market, are buying more expensive components outside… [more]

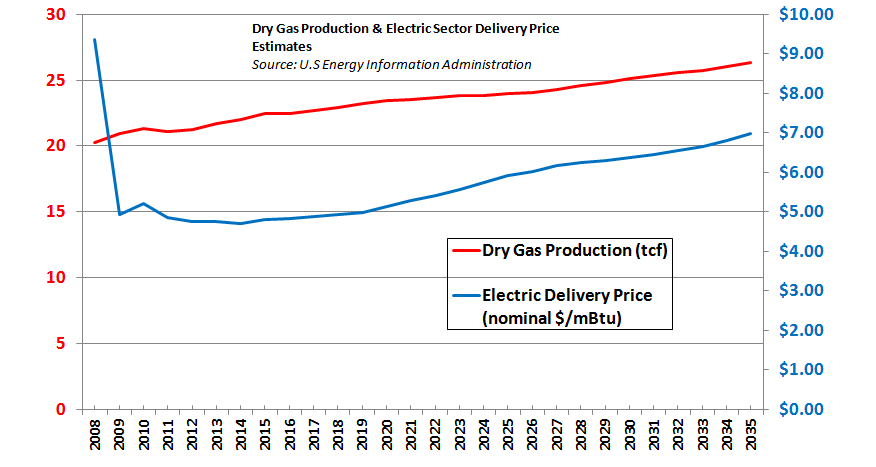

View InsightDomestic natural gas production continues to expand, while natural gas spot prices are at historic lows. Many utilities are responding to these changing market dynamics by building gas plants or “fuel-switching” existing power plants from more expensive fuels to gas. As a result, coal generation continues to fall. Due in part to price competition with natural gas, some Congressional “clean energy” subsidies may not be renewed. EIA projections suggest that domestic production will continue to increase, and that natural gas prices faced by electric utilities will remain below $7.00/mBtu, through 2035. [Source: EIA] What does near- to mid-term domestic natural… [more]

View InsightA new report – coauthored by researchers from the Brookings Institute, the World Resources Institute, and the Breakthrough Institute – examines the coming decline in subsidies and tax breaks for renewables, and what that decline might mean for the U.S. renewables industry. The report argues that the decline imperils the industry, but suggests that this issue presents an opportunity to reform the subsidies and programs currently in place. The American Recovery and Reinvestment Act of 2009 ushered in a brief era of heightened support for the clean tech and renewable energy sectors, providing just over $150 billion through 2014. However,… [more]

View InsightIn an April 26th speech to business leaders at the U.S. Chamber of Commerce, Nick Akins, President and CEO of American Electric Power, urged the U.S. to develop a comprehensive energy policy. Akins explained that a recent “perfect storm of circumstances” – including EPA regulations, diminished reliance on nuclear power, and low natural gas prices – are making natural gas the de facto favored fuel for power generation. This is a concern for Akins, who points out that natural gas prices have been volatile historically, and that relying on a single fuel source for power generation is risky. [Columbia Dispatch]… [more]

View InsightLast week, DOE announced plans to continue its provision of loan guarantees for approved renewable energy projects. The announcement comes seven months after the controversy surrounding the agency’s loan to Solyndra, the California-based solar manufacturer which filed bankruptcy after receiving a $535 million DOE loan guarantee. Solyndra’s loan guarantee was administered under a program authorized by Section 1705 of the American Recovery and Reinvestment Act of 2009, which elapsed in September 2011. The new loans will be directed under a program created by section 1703 of the Energy Policy Act of 2005. The Section 1703 program has $34 billion in… [more]

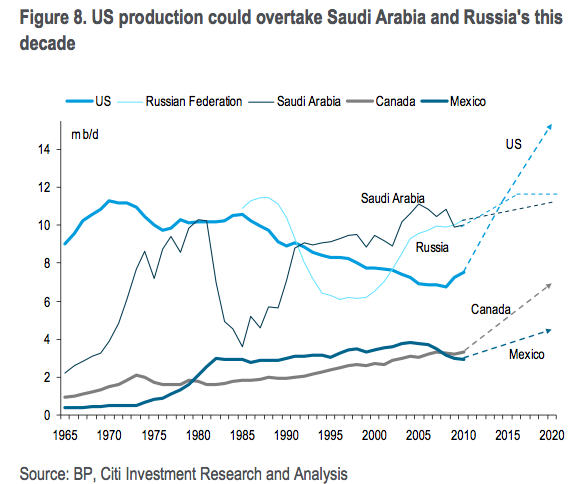

View InsightA Citigroup analysis of North American oil production suggests that the continent could become the “new Middle East.” The report, ENERGY 2020: North America, the New Middle East?, projects increased oil production as having significant effects throughout North American economies, with an increase in the United States’ real GDP of 2.0 to 3.3% from new production, reduced consumption, and associated activity. The report points out that “the main obstacles to developing a North American oil surplus are political rather than geological or technological.” In response to the growth in shale development, state and federal governments are crafting regulations to address… [more]

View InsightLast year, some U.S.-based solar manufacturers filed a complaint, leading the U.S. Commerce Department to conclude that Chinese solar panel manufacturers received unfair subsidies from the Chinese government. Consequently, Chinese solar products were priced artificially low, giving them a competitive advantage in the global market. To address this issue, the U.S. government will be imposing a tariff on Chinese solar products ranging from 2.9% to 4.37%. The aim is to increase the prices of these products and create a fairer market for U.S. manufacturers. In here, it is worth noting that the implementation of tariffs may have an impact on… [more]

View InsightLast week The Economist called attention to growing demand for rare earth minerals, their importance in clean energy technologies, and rising tension over their global supply. Two of these minerals – dysprosium and neodymium – are essential components of the magnets used in wind turbines and electric motors. According to The Economist, for these technologies to play the role expected of them in reducing CO2 emissions, world supply of neodymium and dysprosium would need to increase “more than 700% and 2,600% respectively during the next 25 years.” China, which produces around 90% of the world’s rare earth minerals, has recently… [more]

View InsightSenate Energy & Natural Resources Chairman Jeff Bingaman (D-NM) has introduced the Clean Energy Standard Act of 2012, which would require electric utilities to derive increasing percentages of their supply mix from low-CO2 sources. The bill would take effect in 2015, and would require that by 2035 84% of power from large utilities come from low-CO2 sources. Sources eligible under the legislation include: renewables, such as wind and solar, “qualified” renewable biomass and waste-to-energy, hydropower, natural gas, and nuclear. Facilities with CO2 capture and storage, and some combined heat and power facilities, are also eligible. The bill establishes a market-based… [more]

View InsightJ.C. Ward Jr. Professor of Nuclear Energy Engineering

Cornell University

The President said in his State of the Union Address, “And nowhere is the promise of innovation greater than in American-made energy.” He then talked about opening federal land for oil and gas exploration, implied that relying on foreign oil is not a good thing, and stated, “This country needs an all-out, all-of-the-above strategy that develops every available source of American energy a strategy that’s cleaner, cheaper, and full of new jobs.” Considering the President’s all-of-the-above platform, and the goals implicit in it, we’d be wise to evaluate our national relationship to oil. The U.S. currently produces around 7.6 million… [more]

View Insight