The crude oil price spikes and high fuel costs experienced in the U.S. over the past ten years have encouraged many attempts to identify the underlying causes of these trends. Diminishing oil resources, slowing rates and increasing costs of production, financial speculation and geopolitics are all common arguments used to explain the recent volatile price changes in oil. But is there a correct answer?

The crude oil price spikes and high fuel costs experienced in the U.S. over the past ten years have encouraged many attempts to identify the underlying causes of these trends. Diminishing oil resources, slowing rates and increasing costs of production, financial speculation and geopolitics are all common arguments used to explain the recent volatile price changes in oil. But is there a correct answer?

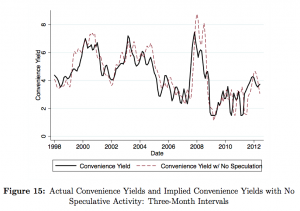

According to a recent MIT study, one theory can be ruled out: financial speculation. “We show speculation had little, if any, effect on prices and volatility,” and may have even decreased prices, wrote the authors of the report. The study relied on the assumption that “a simple model of equilibrium in the cash and storage markets for a commodity can be used to assess the role of speculation as a driver of price changes.” Based on this assumption, the authors concluded that “Unless one believes that the price elasticities of both oil supply and demand are close to zero, the behavior of inventories and futures-spot spreads are simply inconsistent with the view that speculation has been a significant driver of spot prices.”

Does this study rule out financial speculation as a cause for oil price spikes in the U.S.? What are the main drivers of oil price volatility?

MIT’s effort to discern the reasons why oil and gas prices are subject to short term spikes as well as long term trends upward is welcome. Articles in the press… Read more »

Here is another paper from last year that makes a similar argument: http://www-personal.umich.edu/~lkilian/milan030612.pdf Another study from the St. Louis Federal Reserve concluded that speculation was the second most influential factor… Read more »

MIT’s paper reaches a conclusion I agree with, but in a different path than I take. It’s academic and formulaic to such an extent that I’m left behind. Someone recently… Read more »